The Envelope Budgeting System: A Budgeting That Works

Budgeting can be daunting for many, especially in today’s fast-paced digital world, where credit cards and online transactions make it easy to overspend. Amid the plethora of budgeting tools and apps, there’s a traditional yet highly effective method that has stood the test of time: The Envelope Budgeting System. This age-old approach to budgeting offers simplicity and clarity, making it an excellent choice for anyone looking to gain control over their finances.

In this blog post, we’ll delve deep into The Envelope System, exploring how it works, why it’s effective, and how you can implement it in your life. By the end of this article, you’ll have a clear understanding of how this system can help you stick to a budget, avoid debt, and achieve your financial goals.

What is the Envelope Budgeting System?

The Envelope Budgeting System is a cash-based budgeting method that involves allocating physical cash into envelopes labeled for specific spending categories. Each envelope represents a budgeted amount for a particular expense, such as groceries, entertainment, or transportation. Once the cash in an envelope is gone, you can’t spend any more in that category until the next budgeting period.

This method was popularized by financial guru Dave Ramsey, but its roots go much deeper. It’s a simple, straightforward way to manage money that doesn’t require advanced financial knowledge or complex tools—just discipline and commitment.

The Benefits of the Envelope Budgeting System

Using The Envelope System has several benefits that make it an appealing choice for many people:

- Tangible Control Over Spending: Handling physical cash makes spending more real. When you see your money physically leaving your hands, you’re more likely to think twice before making a purchase.

- Eliminates the Temptation of Overspending: Once an envelope is empty, you know you’ve hit your limit for that category. This strict limit helps prevent impulse buying and unnecessary expenses.

- No Need for Credit Cards: By relying on cash, you can avoid credit card debt and the high-interest rates that come with it.

- Simplicity and Accessibility: No need for apps or digital tools—just envelope Budgeting and cash. This makes the system accessible to everyone, regardless of technical skills.

- Helps Build Financial Discipline: The Envelope Budgeting System fosters discipline and encourages thoughtful spending, which can lead to long-term financial health.

How to Set Up the Envelope Budgeting System for Budgeting

Implementing The Envelope Budgeting System is straightforward, but it requires careful planning and commitment. Follow these steps to get started:

1. Determine Your Monthly Income

The first step in setting up The Envelope Budgeting System is to know exactly how much money you have coming in each month. Include all sources of income, such as your salary, side hustles, or any other regular income streams.

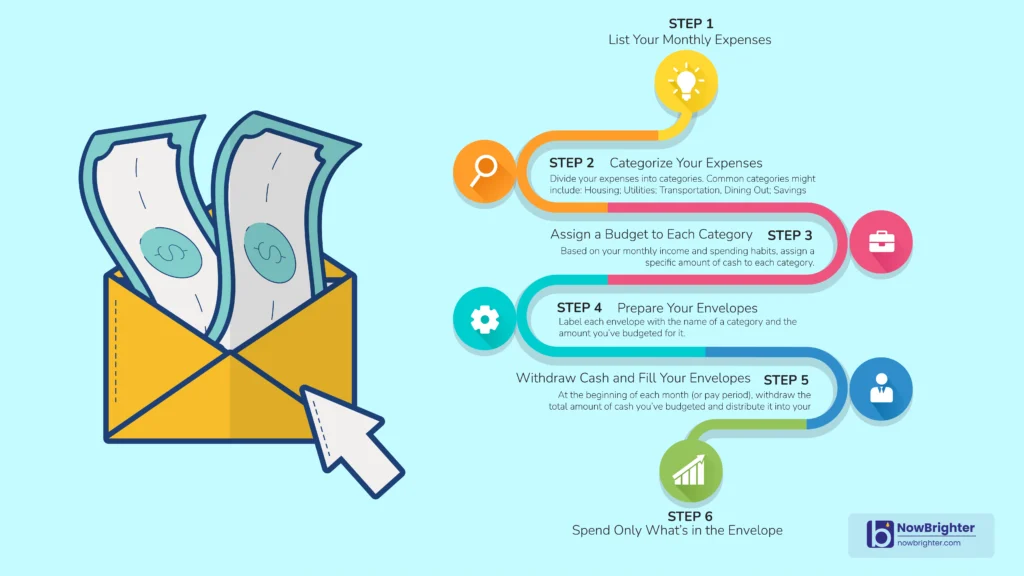

2. List Your Monthly Expenses

Next, make a comprehensive list of your monthly expenses. This includes fixed costs like rent or mortgage payments, utilities, insurance, and variable expenses like groceries, dining out, entertainment, and transportation.

3. Categorize Your Expenses

Divide your expenses into categories. Common categories might include:

- Housing

- Utilities

- Groceries

- Transportation

- Entertainment

- Dining Out

- Savings

- Miscellaneous

These categories will become the labels for your envelopes.

4. Assign a Budget to Each Category

Based on your monthly income and spending habits, assign a specific amount of cash to each category. Be realistic about what you spend in each area. It’s crucial to balance your budget so that your total expenses do not exceed your income.

5. Prepare Your Envelopes

Label each envelope with the name of a category and the amount you’ve budgeted for it. For example, if you’ve budgeted $400 for groceries, write “Groceries: $400” on that envelope.

6. Withdraw Cash and Fill Your Envelopes

At the beginning of each month (or pay period), withdraw the total amount of cash you’ve budgeted and distribute it into your labeled envelopes. This step physically allocates your funds and makes your budget tangible.

7. Spend Only What’s in the Envelope

Throughout the month, use only the cash from the corresponding envelope for each category. When you go grocery shopping, take the “Groceries” envelope with you and pay using the cash inside. If an envelope runs out of money, you must either stop spending in that category or find ways to reallocate funds from other envelopes.

8. Track Your Progress

Regularly check how much cash is left in each envelope. This helps you stay aware of your spending and allows you to adjust if necessary. If you have leftover money in any envelope at the end of the month, you can choose to roll it over to the next month or add it to your savings.

Example of The Envelope Budgeting System in Action

Let’s walk through a hypothetical example to see how The Envelope Budgeting System works in practice.

Monthly Income and Expenses

Imagine you have a monthly income of $3,000 after taxes. Your list of monthly expenses might look like this:

- Rent: $1,000

- Utilities: $200

- Groceries: $400

- Transportation: $150

- Entertainment: $100

- Dining Out: $150

- Savings: $500

- Miscellaneous: $200

Creating the Envelopes

Based on these expenses, you would create envelopes labeled with each category and the amount you’ve budgeted:

- Rent: $1,000

- Utilities: $200

- Groceries: $400

- Transportation: $150

- Entertainment: $100

- Dining Out: $150

- Savings: $500

- Miscellaneous: $200

Using the Envelopes

At the start of the month, you withdraw $2,700 in cash (excluding the $500 for savings, which you may transfer to a savings account) and distribute it among your envelopes. When you go grocery shopping, you take the “Groceries” envelope, and if your total at the checkout is $90, you pay with the cash from that envelope, leaving you with $310 for the rest of the month.

If you find that your “Entertainment” envelope runs out midway through the month, you’ll need to find free or low-cost ways to have fun, or decide if you want to reallocate funds from the “Miscellaneous” envelope. The key is that you don’t spend money that isn’t in the envelope.

How to Handle Emergencies or Unexpected Expenses

One of the common concerns with The Envelope Budgeting System is how to handle emergencies or unexpected expenses. Here are a few strategies:

- Build an Emergency Fund: Before fully diving into The Envelope Budgeting System, ensure you have an emergency fund of at least $1,000. This fund should be kept separate from your envelopes and used only for true emergencies.

- Create a “Buffer” Envelope: Consider having an envelope labeled “Buffer” with a small amount of cash (e.g., $100) to cover unexpected small expenses.

- Reallocate Funds: If an unexpected expense arises, you can choose to take cash from other envelopes to cover it. However, be cautious with this approach to avoid derailing your budget.

- Use Savings: If the unexpected expense is significant and can’t be covered by reallocating envelope funds, dip into your savings. This is why it’s crucial to prioritize saving as part of your budget.

Related Article: 5 Budgeting Tips for College Students: How to Save Money

Why The Envelope Budgeting System Works in Today’s Digital World

In a world dominated by credit cards and digital payments, it might seem outdated to use cash and envelopes. However, The Envelope Budgeting System has proven to be effective even today, and here’s why:

1. Psychological Impact of Cash

When you physically hand over cash, you feel the impact of spending more than when you swipe a card. This tangible loss of money can lead to more mindful spending.

2. Simplifies Financial Management

For those overwhelmed by the complexity of digital budgeting tools, The Envelope Budgeting System offers a straightforward, low-tech alternative that still delivers results.

3. Can Be Adapted for Modern Use

While the traditional method relies on cash, you can adapt The Envelope Budgeting System for digital use. For example, you could use separate bank accounts for different categories or digital “envelopes” within budgeting apps like Goodbudget or EveryDollar. These apps allow you to allocate funds to specific categories without physically handling cash, combining the envelope method with modern convenience.

Overcoming Common Challenges with The Envelope Budgeting System

While effective, The Envelope Budgeting System isn’t without its challenges. Here’s how to overcome some of the common hurdles:

1. Inconsistent Income

If your income varies from month to month, budgeting can be tricky. In this case, consider using your lowest monthly income as a baseline and budget accordingly. During higher-income months, you can allocate extra funds to savings or an emergency fund.

2. Temptation to Reallocate Funds

It can be tempting to “borrow” from one envelope to cover overspending in another category. While occasional reallocation is okay, make it a rule to only do this when absolutely necessary. Frequent reallocation can lead to overspending and defeat the purpose of the system.

3. Cash Security Concerns

Carrying large amounts of cash can be risky. To mitigate this, consider only withdrawing the cash you need for the week, rather than the entire month. Also, store your envelopes in a safe, secure place at home.

4. Adapting to Digital Payments

In situations where you must use a card (e.g., online shopping), consider deducting the spent amount from the appropriate envelope as soon as possible. Alternatively, you can transfer the equivalent amount from your checking account to a savings account as a digital “envelope.”

Success Stories: How The Envelope Budgeting System Has Helped People Achieve Financial Freedom

Numerous individuals and families have successfully used The Envelope System to regain control of their finances. Here are a few inspiring examples:

- Debt-Free Journey: Many people have paid off thousands of dollars in debt by using The Envelope System. By strictly adhering to their budget, they’ve avoided accumulating new debt and systematically paid down existing balances.

- Building Savings: Some users have reported significant increases in their savings by following this method. The disciplined approach to spending allows them to regularly contribute to savings, leading to financial security.

- Living Within Means: Families struggling with living paycheck-to-paycheck have found relief with The Envelope System. By only spending what they physically have in their envelopes, they’ve learned to live within their means and avoid the stress of financial uncertainty.

The Modern Twist: Using Digital Envelopes for Budgeting

As mentioned earlier, it’s possible to adapt The Envelope Budgeting System to a digital format. Several apps allow you to create virtual envelopes, providing the same structure and discipline as the traditional method while accommodating the convenience of digital payments. Here are a few popular options:

- Goodbudget: This app allows you to set up digital envelopes and track your spending in each category. You can sync your budget with multiple devices, making it easy for couples or families to manage their finances together.

- EveryDollar: Created by Dave Ramsey, this app uses a digital version of the envelope method. It’s designed to help you give every dollar a purpose and keep track of your spending.

- Mvelopes: Another digital envelope Budgeting system that allows you to manage your budget online. Mvelopes connects to your bank accounts, automatically categorizes transactions, and helps you stick to your budget.

Conclusion

In a world where financial discipline can be challenging, The Envelope Budgeting System offers a simple, yet powerful solution. By allocating cash to specific spending categories, this traditional approach to budgeting helps you gain control over your money, avoid debt, and achieve your financial goals.

Whether you stick to the classic cash-in-envelopes method or opt for a digital version, the principles remain the same: budget wisely, spend mindfully, and save for the future. It’s time to take charge of your finances—start using The Envelope Budgeting System today and watch your financial health improve.