401(k) vs IRA: Which Retirement Plan Is Better?

When it comes to planning for retirement, selecting the right retirement plan is one of the most important financial decisions you’ll ever make. Whether you’re just starting your career or are a seasoned professional looking to secure your future, understanding the differences between a 401(k) plan and an Individual Retirement Account (IRA) is crucial. Both options offer unique advantages and potential drawbacks, and choosing the right one can have a significant impact on your retirement savings.

In this blog post, we will delve into the specifics of 401(k) plans and IRAs, providing you with a detailed comparison to help you determine which option best suits your financial goals. By the end of this guide, you’ll have a clearer understanding of which retirement plan will best support your journey toward a financially secure retirement.

1. Understanding the Basics: What Is a 401(k) Plan?

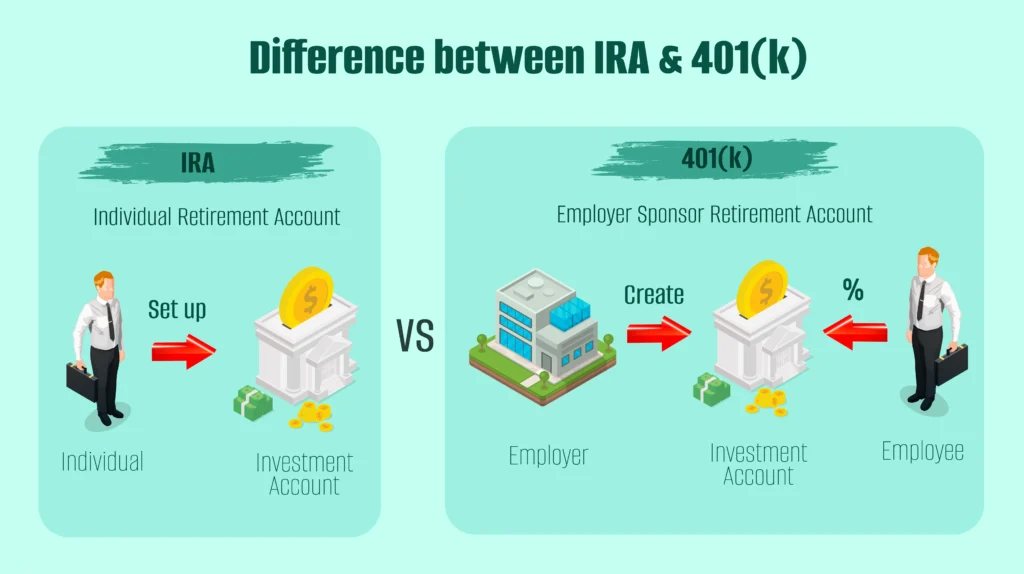

A 401(k) plan is a tax-advantaged retirement plan offered by many employers to their employees. It allows employees to contribute a portion of their pre-tax salary into an investment account, which can grow tax-deferred until retirement. In many cases, employers offer matching contributions, which is essentially free money to boost your retirement savings.

2. What Is an IRA?

An IRA, or Individual Retirement Account, is another popular retirement plan that allows individuals to save for retirement with tax-free growth or on a tax-deferred basis. Unlike a 401(k) plan, an IRA is not tied to an employer, which means anyone with earned income can open one.

3. Contribution Limits: 401(k) Plans vs. IRAs

When it comes to how much you can contribute to each retirement plan, there are significant differences:

- 401(k) Plan: In 2024, the contribution limit for a 401(k) plan is $23,000 for those under 50, with an additional catch-up contribution of $7,500 for those 50 and older.

- IRA: The contribution limit for an IRA is significantly lower, at $6,500 for those under 50, and an additional $1,000 catch-up contribution for those 50 and older.

4. Tax Benefits: How Do 401(k) Plans and IRAs Differ?

Tax benefits are a key consideration when choosing a retirement plan:

- 401(k) Plan: Contributions are made with pre-tax dollars, meaning they reduce your taxable income for the year. The money in your 401(k) plan grows tax-deferred, and you only pay taxes when you withdraw the funds in retirement.

- IRA: Traditional IRAs work similarly to 401(k) plans in that contributions may be tax-deductible, and the funds grow tax-deferred. Roth IRAs, on the other hand, are funded with after-tax dollars, and qualified withdrawals in retirement are tax-free.

5. Employer Contributions: A Major Advantage of 401(k) Plans

One of the biggest advantages of a 401(k) plan is the potential for employer contributions. Many employers offer to match employee contributions up to a certain percentage, significantly boosting your retirement plan savings. For example, if your employer offers a 5% match and you contribute 5% of your salary, you essentially double your savings without any additional cost to you.

6. Investment Options: Diversifying Your Retirement Plan Portfolio

Both 401(k) plans and IRAs offer a variety of investment options, but the scope can differ:

- 401(k) Plan: Investment choices are typically limited to a selection of mutual funds, which may include stock funds, bond funds, and target-date funds. The specific options are determined by the plan provider chosen by your employer.

- IRA: IRAs generally offer a wider range of investment options, including individual stocks, bonds, mutual funds, ETFs, and more. This flexibility allows you to tailor your investments to better suit your risk tolerance and financial goals.

≫ Learn More: The Basics of 401(k) Plans: What You Need to Know

7. Fees and Expenses: Comparing Costs Between 401(k) Plans and IRAs

Fees can eat into your retirement savings, so it’s essential to understand the costs associated with each retirement plan:

- 401(k) Plan: Fees can vary depending on the plan provider and the investment options available. Administrative fees, investment management fees, and other charges can add up over time, potentially reducing your overall returns.

- IRA: IRAs often have lower fees than 401(k) plans due to the broader range of providers and investment options. However, costs can still vary widely depending on the provider and the investments you choose.

8. Required Minimum Distributions (RMDs): When You Must Start Withdrawing

Both 401(k) plans and traditional IRAs have rules about Required Minimum Distributions (RMDs), which are mandatory withdrawals that must start after you reach a certain age:

- 401(k) Plan: RMDs must begin by April 1 of the year after you turn 73. If you’re still working and do not own more than 5% of the company, you may be able to delay RMDs from your current employer’s 401(k) plan.

- IRA: RMDs also begin at age 73, but there are no exceptions based on employment status.

9. Roth 401(k) vs. Roth IRA: Which Offers Better Tax Advantages?

Both 401(k) plans and IRAs have Roth versions, which are funded with after-tax dollars but offer tax-free withdrawals in retirement:

- Roth 401(k): Contributions are made with after-tax dollars, and withdrawals in retirement are tax-free. Roth 401(k) plans also have higher contribution limits than Roth IRAs.

- Roth IRA: Similar to a Roth 401(k) plan, but with lower contribution limits and no RMDs, making it a valuable tool for those who want to avoid forced withdrawals in retirement.

≫ Learn More: How to Choose the Right Retirement Plan for You

10. Flexibility and Accessibility: Which Plan Offers More?

Flexibility is an important factor in choosing the right retirement plan:

- 401(k) Plan: Funds are generally less accessible before retirement. Early withdrawals typically incur a 10% penalty in addition to income taxes, though some plans offer loan provisions or hardship withdrawals.

- IRA: IRAs offer more flexibility with the ability to withdraw contributions (but not earnings) at any time without penalty. Roth IRAs are even more flexible, allowing for tax- and penalty-free withdrawals of contributions at any time.

11. Portability: Moving Your Retirement Savings

Life changes, and so do jobs. It’s important to understand how portable your retirement plan is:

- 401(k) Plan: When you leave a job, you can roll over your 401(k) plan into a new employer’s plan or into an IRA without incurring taxes or penalties. However, leaving the funds in your former employer’s plan is also an option.

- IRA: Since an IRA is not tied to an employer, it offers ultimate portability. You can transfer or roll over an IRA from one provider to another without penalties or tax implications.

12. Impact of Income Level: Which Plan Is Better for High Earners?

Your income level can affect which retirement plan is more advantageous:

- 401(k) Plan: High earners can benefit from the higher contribution limits of a 401(k) plan. Additionally, because contributions are made with pre-tax dollars, the tax deferral can be particularly beneficial for those in higher tax brackets.

- IRA: Income limits apply to Roth IRA contributions, and the ability to deduct contributions to a traditional IRA phases out at higher income levels if you’re also covered by a 401(k) plan at work.

13. Example Scenario: Comparing a 401(k) Plan and an IRA

Let’s consider an example to illustrate how a 401(k) plan and an IRA might compare:

Imagine you’re 35 years old, earning $80,000 per year, and you plan to retire at age 65. You contribute 10% of your salary to your 401(k) plan, and your employer matches 5%. You also decide to contribute the maximum allowed to an IRA.

- 401(k) Plan: With a 10% contribution, you’re saving $8,000 per year, plus your employer’s $4,000 match, totaling $12,000 annually. Assuming a 7% annual return, your 401(k) plan could grow to approximately $1,143,000 by retirement.

- IRA: Contributing the maximum of $6,500 per year to your IRA with the same 7% return could result in a balance of around $650,000 by retirement.

In this scenario, the 401(k) plan offers a significant advantage due to the higher contribution limits and employer match.

14. Making the Decision: 401(k) Plans vs. IRAs

Choosing between a 401(k) plan and an IRA depends on your individual financial situation, goals, and preferences. If your employer offers a 401(k) plan with a matching contribution, it’s often wise to take full advantage of that benefit before considering an IRA. On the other hand, if you value a broader range of investment options and greater flexibility, an IRA might be the better choice.

15. Why Not Both? Maximizing Your Retirement Savings

For many people, the best strategy might not be choosing between a 401(k) plan and an IRA, but rather, contributing to both. By maximizing your contributions to a 401(k) plan and then contributing to an IRA, you can take advantage of the unique benefits offered by both types of retirement plans. This approach allows you to boost your retirement savings while diversifying your tax advantages and investment options.

Conclusion

When it comes to securing your financial future, choosing the right retirement plan is crucial. Both 401(k) plans and IRAs offer valuable benefits, and the best choice depends on your unique financial situation and retirement goals. A 401(k) plan might be the better option if you’re looking for higher contribution limits and employer matching, while an IRA offers greater flexibility and a wider range of investment options.

However, why choose just one? By contributing to both a 401(k) plan and an IRA, you can maximize your savings, take full advantage of tax benefits, and ensure that your retirement years are as comfortable and financially secure as possible.

Now is the time to take action. Review your current retirement savings strategy, consult with a financial advisor if necessary, and start making the most of your retirement plan options today. Your future self will thank you.