50/30/20 Rule-The Best Budget Rule for Beginner

Are you struggling to manage your finances? Do you find yourself constantly worrying about money? It’s time to introduce a game-changer in your financial life: the 50/30/20 budget rule. This simple yet effective method is perfect for beginners who want to take control of their spending and save for the future. Understanding this rule could be the first step towards financial freedom. In this post you will learn:

- What is the 50/30/20 Rule?

- Benefits of the 50/30/20 Budget Rule

- Achieving Financial Goals with the 50/30/20 Rule

What is the 50/30/20 Rule?

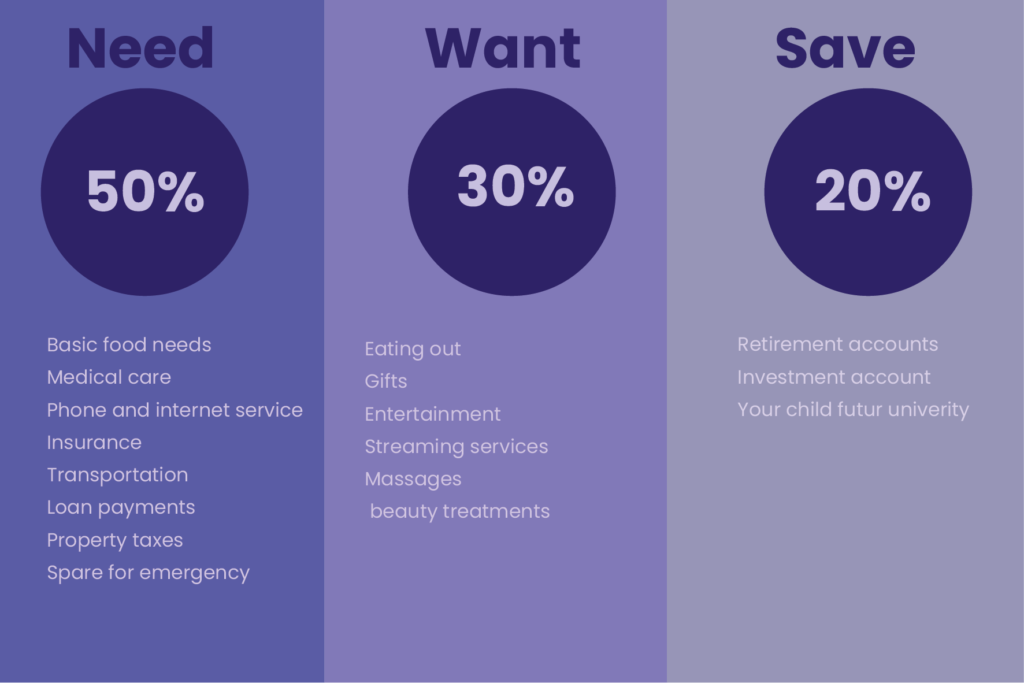

The 50/30/20 rule is a budgeting framework that divides your after-tax income into three categories:

50% – Needs

This portion of your budget is allocated to essential expenses, such as:

- Rent or mortgage

- Utilities

- Groceries

- Transportation

- Insurance

For example, if your monthly take-home pay is $3,000, you would allocate $1,500 to cover these necessities.

30% – Wants

This segment is for the non-essential items that enhance your lifestyle, like:

- Dining out

- Entertainment

- Shopping for non-necessities

- Subscriptions and memberships

Using the same income example, $900 would be set aside for these personal desires.

20% – Savings or Debt Repayment

The final slice of your income pie goes towards building your future, which includes:

- Savings

- Investments

- Extra payments on debt

From the $3,000, this means $600 is used to secure your financial well-being.

Benefits of the 50/30/20 Budget Rule

- Simplicity: The beauty of the 50/30/20 rule lies in its straightforward approach. There’s no need for complex spreadsheets or financial jargon. It’s a budgeting method that anyone can start using right away, regardless of financial expertise. By simply dividing your income into three categories, you can easily see where your money is going and make adjustments as needed. This simplicity also makes it less intimidating for those new to budgeting, encouraging them to stick with it.

- Flexibility: Life is unpredictable, and your budget should be able to adapt. The 50/30/20 rule offers the flexibility to adjust your spending as your financial situation changes. If you get a raise, for instance, you can decide to allocate more to your savings or pay down debt faster. Conversely, if you face unexpected expenses, you can temporarily adjust your ‘wants’ category to accommodate these changes without derailing your entire budget.

- Balance: One of the key strengths of the 50/30/20 rule is its emphasis on balance. It recognizes the importance of covering your needs and saving for the future while still allowing room for enjoyment. This balance prevents the feeling of deprivation that can come with more restrictive budgeting methods, making it more sustainable in the long run. It’s a holistic approach that caters to various aspects of your financial health.

- Control: Gaining control over your finances can be empowering. The 50/30/20 rule provides a clear framework for managing your money, which can help reduce financial stress. Knowing exactly how much you can spend in each category prevents overspending and helps avoid debt accumulation. With this rule, you’re in the driver’s seat, making proactive decisions about your financial future.

- Goal-Oriented: Setting and achieving financial goals is crucial for long-term financial health. The 50/30/20 rule is designed to help you work towards your goals systematically. By allocating 20% of your income to savings and debt repayment, you’re consistently working towards milestones like building an emergency fund, saving for a down payment on a home, or investing for retirement. This methodical approach ensures that you’re always moving forward on your financial journey.

Achieving Financial Goals with the 50/30/20 Rule

- Track Your Spending: The first step in mastering the 50/30/20 rule is to track every dollar you spend. This means keeping a close eye on all your transactions, whether that’s through a budgeting app, a spreadsheet, or a simple notebook. For instance, if you spend $100 on dining out, make sure to record it under ‘wants’. By doing this consistently, you’ll gain a clear understanding of your spending habits, identify areas where you can cut back, and ensure you’re not exceeding the 30% allocated for wants or the 50% for needs.

- Automate Your Savings: To make saving effortless, automate the process. Set up a direct deposit from your paycheck into a savings account or an investment fund. For example, if you’re following the 50/30/20 rule on a $3,000 monthly income, you can arrange to have $600 automatically transferred to your savings account every month. This ‘out of sight, out of mind’ strategy helps you stick to the 20% savings goal without the temptation to spend that money elsewhere.

- Prioritize Your Debts: Prioritizing debt repayment is crucial, especially if you have high-interest debts like credit card balances. Start by listing all your debts and their interest rates. Then, allocate the 20% of your budget meant for savings and debt repayment towards the highest interest debt first, while making minimum payments on the others. Once the highest interest debt is paid off, move to the next one. This method, known as the avalanche method, reduces the amount of interest you pay over time and frees up more money for savings in the long run.

Conclusion

The 50/30/20 rule isn’t just a budgeting technique; it’s a mindset that encourages financial responsibility and proactive planning. Start small, stay consistent, and watch as your financial health transforms. Remember, the journey to financial stability begins with a single step – make yours today!