The Ultimate Guide to Create Multiple Streams of Income for Long-Term Wealth

In today’s fast-paced financial world, relying on a single source of income is no longer enough to ensure long-term wealth. The secret to building lasting financial security lies in creating multiple streams of income. Whether you’re looking to supplement your salary, invest in passive income opportunities, or diversify your financial portfolio, understanding how to generate multiple streams of income is crucial. In this guide, we’ll explore proven strategies and actionable steps to help you build a diversified income system that can grow and sustain your wealth for years to come. Ready to take control of your financial future? Let’s dive in!.

In this guide, we’ll walk you through the types of income streams you can create, and give you a step-by-step process to build a solid foundation for sustainable, long-term wealth.

Why Multiple Streams of Income Are Critical for Long-Term Wealth

Having multiple income streams is essential for long-term wealth building because it reduces the risk associated with relying on just one source of income, like a job or single investment. Life is unpredictable—sudden layoffs, industry changes, or personal emergencies can quickly derail your finances if you’re solely dependent on one paycheck.

By creating diversified income streams, you spread out financial risk, allowing you to maintain a steady cash flow even when one income source slows down. This approach also accelerates wealth accumulation by introducing various revenue sources that compound over time, making your financial goals more attainable.

What Are Multiple Income Streams?

Income streams can be broken down into two broad categories:

Active Income

Active income refers to money earned through work. This includes a salary from a job, freelance work, or money earned from a business where you are directly involved. The more hours you work, the more you can earn, but it requires your ongoing effort.

Passive Income

Passive income, on the other hand, is money earned with minimal ongoing effort after an initial setup. Common passive income streams include rental income, dividends, royalties, or profits from automated businesses. Once the income stream is established, it generates revenue without requiring constant active participation.

Benefits of Building Multiple Income Streams

- Financial Security: By diversifying your income, you reduce your dependence on a single paycheck.

- Wealth Accumulation: Passive income streams grow over time and can compound, helping you accumulate wealth faster.

- Freedom and Flexibility: Multiple income streams provide financial freedom, allowing you to work on projects you’re passionate about or retire early.

- Protection from Economic Shocks: If one stream dries up (e.g., a job loss or market downturn), others will continue to provide support.

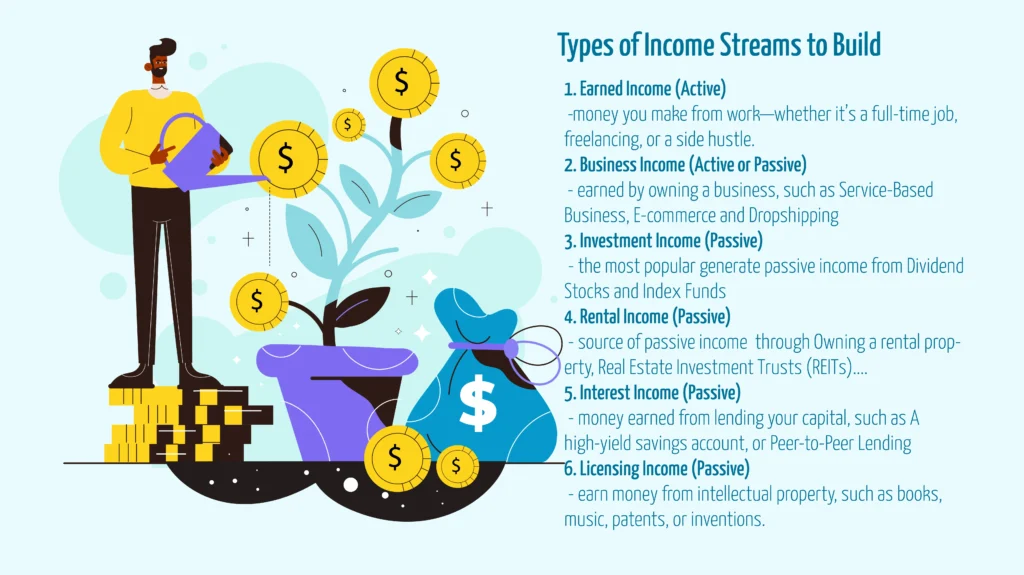

Types of Income Streams to Build

Let’s explore the various types of income streams, ranging from active to passive, that can help you build long-term wealth.

1. Earned Income (Active)

Earned income is the money you make from work—whether it’s a full-time job, freelancing, or a side hustle. While it’s often the primary source of income, earned income can be maximized or expanded upon to kickstart other income streams.

How to Maximize Earned Income

To increase your earned income:

- Invest in career development: Take courses, earn certifications, or build skills that qualify you for higher-paying roles.

- Job hopping: Changing jobs can often result in a higher salary. Be strategic about timing and negotiations.

- Freelancing or side hustles: If you’re looking for more income without changing jobs, start a side hustle. Common side gigs include freelance writing, graphic design, or selling products online.

Side Hustles That Can Grow into Larger Income Sources

A side hustle not only boosts your earned income but can evolve into a full-fledged business. For example, freelance web designers can eventually hire a team and grow into a digital marketing agency, turning active income into a more passive stream as the business scales.

2. Business Income (Active or Passive)

Business income is earned by owning a business. Depending on how the business is structured, it can be an active income source initially and transition into passive income over time through automation or delegation.

Starting a Service-Based Business

Starting a service-based business—such as consulting, coaching, or tutoring—requires your direct involvement at first, making it an active income stream. Over time, you can scale the business by hiring employees or outsourcing tasks, turning it into a passive income source.

E-commerce and Dropshipping

E-commerce businesses, particularly dropshipping, allow you to sell products without holding inventory. With dropshipping, you act as the middleman between the supplier and the customer. Once the business is automated (through tools for order processing and customer service), it can become a source of passive income.

3. Investment Income (Passive)

Investment income is one of the most popular and reliable ways to generate passive income. With smart investing, you can grow your wealth exponentially over time.

Dividend Stocks and Index Funds

Investing in dividend-paying stocks allows you to earn a portion of a company’s profits on a regular basis. Dividends provide a steady stream of passive income. Index funds, which track entire market segments, offer diversified exposure and long-term growth potential with less risk than individual stocks.

Compound Growth Through Reinvesting Dividends

Reinvesting your dividends allows you to benefit from compound growth. As you earn dividends, reinvest them to purchase additional shares. Over time, this snowball effect increases the value of your investment and the amount of dividend income you earn.

4. Rental Income (Passive)

Real estate can be a lucrative source of passive income, especially through rental properties. Owning real estate allows you to collect monthly rent payments, while also benefiting from property value appreciation over time.

Traditional Rental Properties

Owning a rental property—whether residential or commercial—provides ongoing cash flow through rental payments. While managing tenants can be time-consuming initially, hiring a property manager can turn rental properties into a largely passive income source.

Real Estate Investment Trusts (REITs)

For those who want to invest in real estate without owning property directly, Real Estate Investment Trusts (REITs) are a great alternative. REITs allow you to invest in real estate and receive dividend payments, but without the hassle of property management.

5. Interest Income (Passive)

Interest income is money earned from lending your capital. Whether through traditional financial institutions or peer-to-peer lending platforms, interest income is a simple way to grow wealth passively.

High-Yield Savings Accounts and CDs

A high-yield savings account or certificate of deposit (CD) provides low-risk interest income. While the returns may be modest compared to stocks, these are safe places to store your emergency fund or short-term savings while earning a return.

Peer-to-Peer Lending for Higher Returns

For higher returns, consider peer-to-peer lending through platforms like LendingClub or Prosper. These platforms allow you to lend money to individuals or small businesses in exchange for interest payments. While riskier than traditional savings accounts, peer-to-peer lending can offer higher returns.

6. Royalties and Licensing Income (Passive)

Royalties and licensing income allow you to earn money from intellectual property, such as books, music, patents, or inventions. This type of income continues to generate revenue as long as people use or purchase your work.

Royalties from Intellectual Property

Authors, musicians, software developers, and artists can earn ongoing royalties from their creative works. For example, an author can earn royalties on book sales, or a musician can earn royalties whenever their songs are streamed or played on the radio.

Licensing Products or Inventions

Licensing a product or invention to a company can generate royalty payments without you needing to manage manufacturing or distribution. This can be particularly profitable if the product becomes widely used.

≫ Learn More: The Role of Side Hustles in Achieving Financial Freedom

Steps to Start Building Multiple Income Streams

In today’s uncertain economy, relying on a single source of income can feel like walking a financial tightrope. Diversifying your income by building multiple streams not only provides security but also creates opportunities for wealth accumulation and financial independence. However, knowing where to start and how to effectively balance new ventures can be challenging. This guide outlines four essential steps to help you strategically build and manage multiple income streams, whether you’re looking to supplement your current earnings or establish passive income for the future.

Step 1: Conduct a Comprehensive Financial Assessment and Set Clear Goals

Before starting, it’s essential to take stock of your current financial situation and define your goals. This ensures you are in the best position to move forward and choose income streams that align with your long-term vision.

- Assess your current financial situation: Review your income, expenses, and overall financial health. Understand your monthly cash flow and how much you can allocate toward new income-generating ventures.

- Define your financial goals: Identify both short-term and long-term objectives. Short-term goals may include earning an additional $500 per month, while long-term goals could focus on passive income or financial independence.

- Invest in education: Learn about various income-generating opportunities through books, online courses, or mentors. Building expertise in areas like investing, entrepreneurship, or digital marketing can open more income streams for you.

Step 2: Identify, Evaluate, and Test Potential Income Streams

Once you have assessed your finances and set clear goals, it’s time to explore and test different income streams. This step is about discovering what works best for you in terms of profitability, sustainability, and alignment with your interests.

- Understand active vs passive income: Active income requires ongoing effort (e.g., freelancing or consulting), while passive income (e.g., investments or digital products) generates revenue with minimal involvement after setup.

- Explore different income options:

- Side hustles: Freelancing, consulting, part-time jobs.

- Investments: Stocks, bonds, mutual funds.

- Online businesses: E-commerce, blogging, affiliate marketing.

- Real estate: Renting properties, house flipping.

- Start small and test: Experiment with side hustles or low-risk investments before committing significant resources. This helps you learn what works best with your skills, interests, and lifestyle.

Step 3: Optimize Through Automation and Strategic Scaling

Once you’ve identified profitable income streams, the next step is to optimize and scale them. Streamlining processes and expanding your ventures allows you to grow without becoming overwhelmed by the demands of managing multiple streams.

- Leverage your network: Use your contacts to find opportunities, collaborations, or clients that can help you grow your ventures.

- Automate your income streams: Use tools to automate tasks such as payment processing, customer service, or portfolio management. This is crucial for online businesses and investments.

- Scale your efforts: Grow your ventures by expanding services or increasing product offerings. For instance, if freelancing, consider hiring additional help to manage more clients, or invest in additional properties if you’re involved in real estate.

Step 4: Diversify Your Portfolio and Regularly Review Performance

As your income streams grow, diversification becomes essential. Spreading your investments across different sectors and monitoring their performance ensures that your portfolio is well-balanced and resilient to market changes.

- Diversify across industries and income types: Balance active and passive income streams, spreading your investments and activities across different sectors (e.g., freelancing, real estate, digital products).

- Monitor performance: Regularly review how each income stream is performing in terms of profitability and time investment. Identify which streams are worth scaling and which may need improvement.

- Adjust your strategy: If one stream underperforms, make changes to boost its profitability, or shift focus to more successful ventures. Flexibility is key to long-term success.

Common Mistakes to Avoid When Building Multiple Income Streams

While creating multiple income streams is a smart financial strategy, there are some common mistakes to avoid:

Overloading Yourself with Too Many Streams at Once

Trying to build too many income streams simultaneously can lead to burnout and financial mismanagement. Focus on one or two streams first and expand as you gain experience.

Underestimating Initial Costs and Effort

Starting a business, buying rental property, or investing in stocks all require an initial investment of time and money. Make sure to plan for these costs and budget accordingly.

Failing to Reinvest Income for Growth

One of the biggest mistakes people make is spending all the money they earn from their new income streams. Instead, reinvest profits into growing the income stream or creating new ones. This accelerates wealth building and helps you reach financial independence faster.

Conclusion: Achieving Long-Term Wealth Through Multiple Income Streams

Creating multiple income sources is one of the most effective ways to build long-term wealth and achieve financial freedom. By diversifying your income across active and passive streams, you reduce financial risk and set yourself up for sustainable growth.

Start with one income stream, master it, and then expand into others. Whether through investing, real estate, business ownership, or royalties, building multiple income streams will ensure that your wealth continues to grow for years to come.